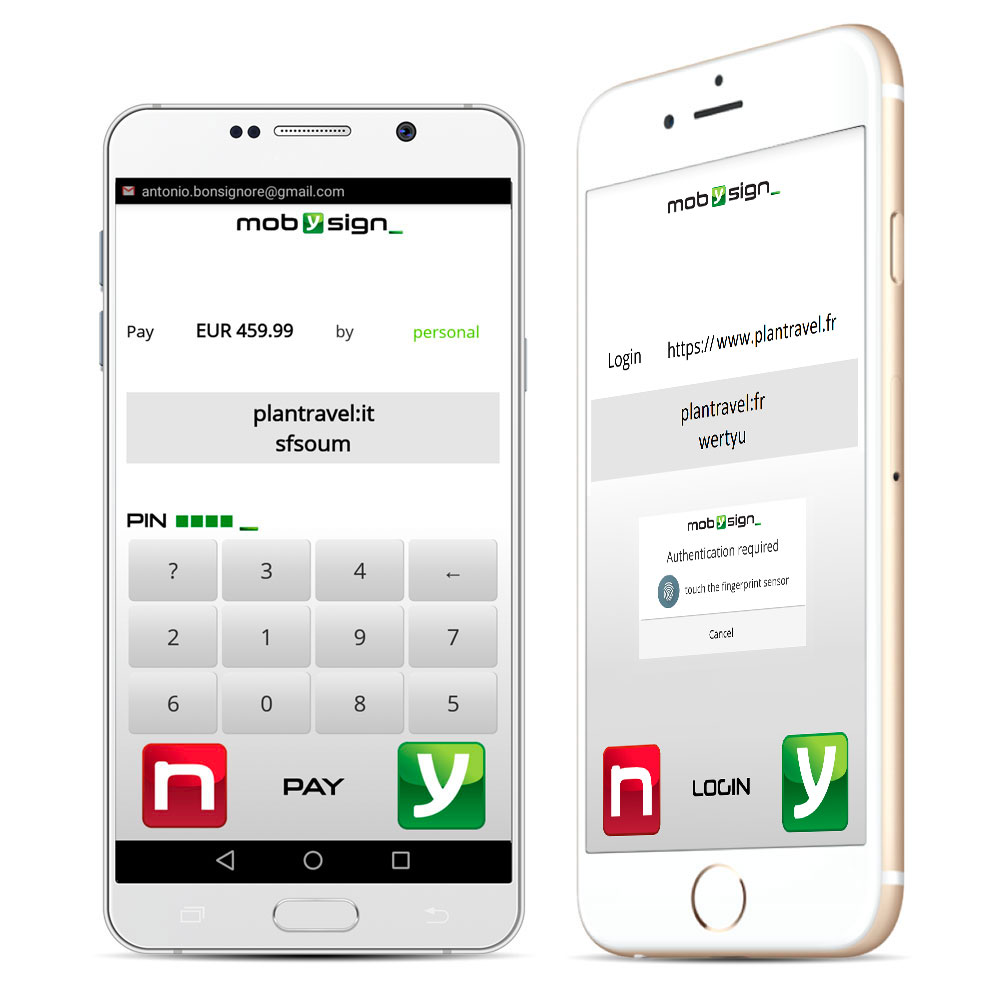

No matter the device you start from: in any case a popup appears on your smartphone waiting for your confirmation

you can use Mobysign in points of sale and online payments, logins, for orders and documents to sign

Your fingerprint or one PINDuring registration, you can choose a unique PIN or your fingerprint. To confirm the popup no matter whether your profile is a personal or corporate one |

Compare informationOn the popup and where you started the operation. Without copying any code for your best user experience. Two independent channels for your safety. If codes are the same, you can confirm! |

No sensitive data over the NetWe only transmit your PKI signature of every transaction data: just no sensitive data from your smartphone/tablet! No credit card numbers, no passwords over the Net! |

A unified user interfaceTo access your digital world or pay. From any device. At the point of sale, online, at home, in the office, while walking … because it’s always you. Finally handy the digital world around you! |

The highest security level

- PKI signature on smartphone

- multifactor authentication

- two independent channels to compare information

- each affiliate service integrates the solution within their systems to verify just their transactions

- a distributed architecture, but the user’s convenience of using only one app

- PCI Certification

- compliance with PSD2, its RTS, eIDAS and SPID regulations

How can I use Mobysign?

several ways to start:

Download the app and enter Mobysign world.

Here you’ll find some tips which help you to get started.

Just download the app from your operating system store and tap the icon. If you haven’t received an activation code or green QRcode from any affiliated entity such as your bank, choose the default option and enter the few required data. In alternative, select the entity providing you with registration data and proceed. When you choose between a PIN or your fingerprint, you will be immediately enabled to log in and sign documents. If you are logging in with a green activation code or QRcode received from your bank, you may also be activated for payments directly from your bank, if you find this information during the registration. In any case, you can register data of one or more credit cards of your bank freely, proceeding with the procedure. After the registration of each card, you can associate a profile to automatically forward shipping and billing data when you make a purchase. You can also complete profile data later. The ‘me’ profile is the default one, but you can create new ones, for your personal use or for business, by typing default shipping and billing data for each profile … Then, start using Mobysign!

Depending on the merchant, there are several means to start a payment:

- points of sale may enable your barcode to be scanned at the till: you show your Mobysign barcode appearing on the app main view, or the specific merchant barcode loyalty you find on the Mobysign app; the cashier or the self till reads the barcode displayed on your smartphone;

- A point of sale may enable the till with Mobysign QRcode: this is affixed near the till. Scan it with Mobysign app. Do the same thing if you are at a petrol station where the QRcode is placed on the petrol pump near your car. In some restaurants, in alternative, you can find QRcode at your table: you can scan when you want the bill and pay

- Billboards or magazines: it’s enough to scan QRcode;

- A QRcode is displayed on the websites to be scanned with Mobysign app;

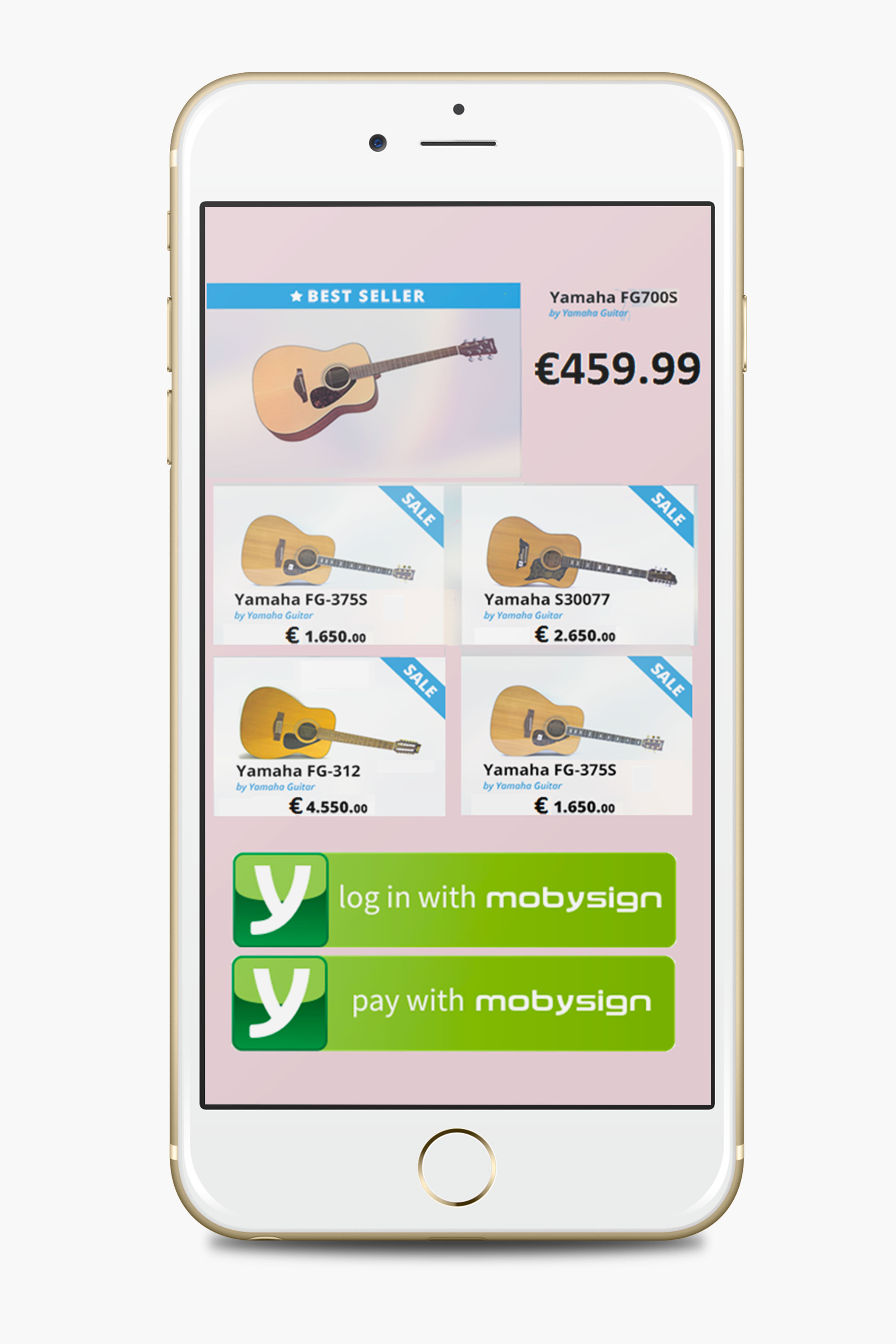

- On some apps or mobile sites just press pay with mobysign button, as indicated;

- Call to make your order, for example to have pizzas delivered at home

- Receive a popup from automated systems such as your insurance before the policy expires

In any case, you will receive a popup on your smartphone and you will be able to pay with your PIN or fingerprint, after checking that the popup information matches the ones on the means you started.

If you want, before you can confirm, you can first change the payment method or the preselected profile.

You can log in to websites and apps by avoiding signing up; to start the login on the websites you can see a QRcode to scan with Mobysign app; on some apps or mobile websites just press log in with mobysign button. In any case you will receive a popup on your smartphone and you’ll be able to log in with your PIN or fingerprint, after checking that popup information matches with information present on the means the transaction started from.

You or the entity that requires your signature will upload the document to an affiliate website. You will receive a popup with the signature request. Once you have verified your document by email or app, you can confirm it with your PIN or fingerprint.

Any order with Mobysign is confirmed as in point 3

You can use Mobysign on websites, portals, e-commerce, apps, home and mobile banking systems, points of sale, digital signatures and digital identity services affiliated.