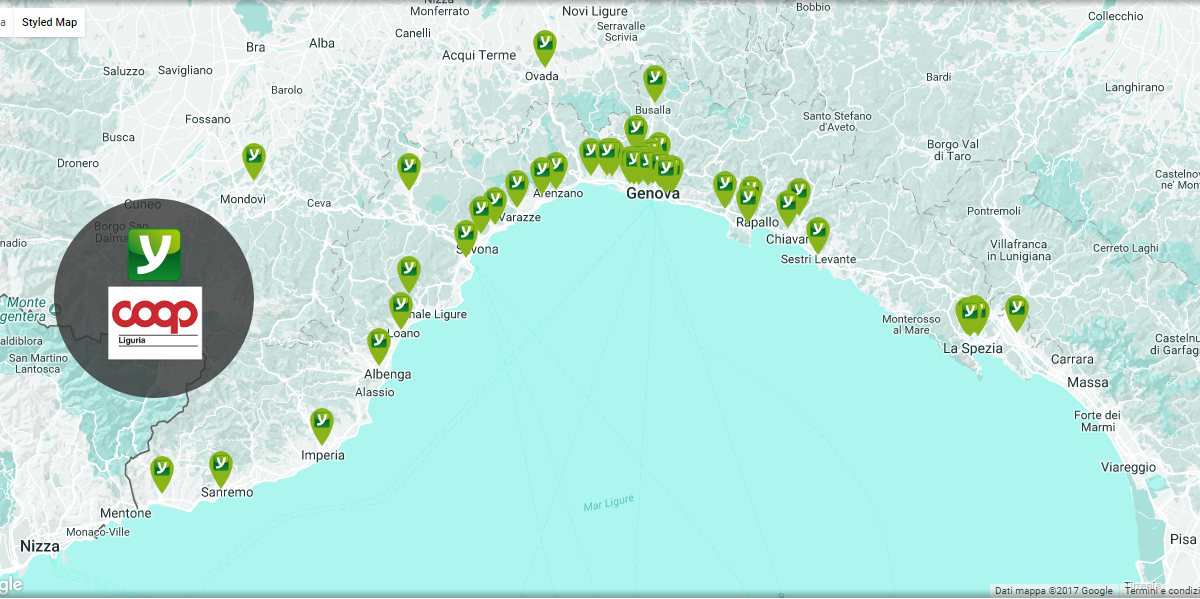

From now on, pay with Mobysign at all tills of Coop Liguria hypermarkets and supermarkets, in all 43 Coop Liguria points of sale

From now on, pay with Mobysign at all tills of Coop Liguria hypermarkets and supermarkets, in all 43 Coop Liguria points of sale

September 30, 2017

From now on, pay with Mobysign at all tills of Coop Liguria hypermarkets and supermarkets, in all 43 Coop Liguria points of sale, including some in the Piedmont territory.

A great result in collaboration with Coop Liguria, after the positive trial of the past months. A confirmation that Mobysign’s security and usability innovation is gaining ground not only in the web but also in the GDO as a reference solution as structured, pragmatic, user-friendly and compliant with the European PSD2 Payment Directive.

Among the advantages of the solution, according to Coop Liguria, is that Mobysign is not related to a specific type of smartphone, telephone carrier, or a specific bank and can also be used for other services such as ecommerce sites or to log in to websites.

The customer simply downloads the standard Mobysign app on his/her smartphone from the store or iCoop app; then he/she registers one or more credit cards (and some types of international debt) no matter the bank the customer has; no need to send documents of any kind and he/she is immediately enabled in both Coop Liguria and other merchants. You can use the convenient plafond of your cards without recharging from your IBAN, so you avoid fees charged by your bank:

MOBYSIGN IS COMPLETELY FREE FOR CONSUMER, WITHOUT SURPRISES, WITHOUT ADDITIONAL, DIRECT OR INDIRECT COSTS!

The plafond and payment are protected by the safety of Mobysign patented throughout Europe (and patent pending in the United States) starting from 2011.

Mobysign, the free app instead of wallet and thousands of passwords, in Coop Liguria leverages the ability to pay with a frictionless user experience without typing amounts, without selecting the point of sale, without being obliged to activate geolocation services, which are not always appreciated by everyone of us for privacy reasons.

In the case of Coop Liguria, it is enough to read QR code with the app at the till: a popup appears automatically on the client’s smartphone, returning the transaction data, including the till number, the amount and the point of sale; at this point the customer can safely confirm the payment with all the guarantees that it is about his purchase. The consumer just uses the fingerprint or type a unique PIN and … done in a few seconds. The app signs the transaction – not leveraging the SIM of the phone operator – and sends full dynamic linking PSD2 confirmation. A process, even this, patented by Mobysign. In this way, confirmation of a payment can’t be used by others for different transactions and towards other beneficiaries.

Payments to Coop Liguria include SIX Payment Services, an international acquirer operating throughout Europe and owned by UBS and Credit Suisse. SIX servers in Zurich (SIX owns Zurich Stock Exchange) receive in a moment the card numbers from Mobysign certified PCI servers. Yes, because on the smartphone there is no card data, no part of them, no personal data. The app does not know all the card data, even in the registration phase! This further enhances the level of security and privacy guaranteed.

From the point of view of usability, the ease of use is almost embarrassing, because the smartphone becomes a kind of remote control from which to point QRcode on the traditional or self till, to get all data in one click and approve a payment in a few seconds. It is possible to change the card with a simple gesture when the popup appears.

Thanks to the integration of NCR, the Winepts till system (version 7.0) provides the standard package for Mobysign payments.

In general, other means are alternative to trigger Mobysign transaction at the point of sale: barcode, gift card or loyalty cards, native on the mobile. The same QRcode mechanism can also be used on websites, both for payment, for sending automatic billing and billing data, and for logins, avoiding to keep in mind myriads of passwords and type data when we register. It is also possible to integrate an app to Mobysign in a very simple way and to let the user type his/her phone number or nickname to start a transaction. Mobysign’s verticals for GDO, catering, fashion, fuel stations, banks and more are in the direction of offering a valid solution in many contexts on the market.

Mobysign is NOT a financial institution and is NOT interested in proposing, at least for now, its own financial means of alternative payment to those of the circuits, nor to activate payments just through credit cards; it is open to partner circuits and also, based on the opportunities offered by PSD2 and above all the fees charged, will be able to activate further means by relying on the complete compliance of the solution with the new directive. At present, credit/debit cards offer a consolidated, economical, and standard system that Mobysign has made easier and safer with the use of its app.

Mobysign is a wallet in the strictest sense, because it does not prefer its own financial means of payment, but offers a viable solution over time in the market, by choosing the best options; it is a self-financed company that came from Italy and has arrived in London, has shown over time that it is interested in creating value for real business and not speculative games.

Finally, a special thank you to Dr. Giovanni Battista Clavarino, Hypermarket Organizing Manager and Innovation Coop Liguria and President of Energya SpA who followed the project, Coop Liguria and Coop CNO.